The Federal Government has flagged off a free nationwide training programme aimed at equipping 10 million Nigerians with financial literacy and inclusion skills.

This was announced in a statement by Stanley Nkwocha, Senior Special Assistant to the President on Media and Communications.

The training programme prioritises women and youth, focusing on essential financial skills, digital competencies, and investment knowledge to support sustainable wealth creation in Nigeria’s growing digital economy.

Purpose of the Training Programme

The Federal Government has flagged off a free nationwide training programme aimed at equipping 10 million Nigerians with financial literacy and inclusion skills.

This was announced in a statement by Stanley Nkwocha, Senior Special Assistant to the President on Media and Communications.

The training programme prioritises women and youth, focusing on essential financial skills, digital competencies, and investment knowledge to support sustainable wealth creation in Nigeria’s growing digital economy.

FG Signs MoU With Professional Bodies

To deliver the programme effectively, PreCEFI signed a Memorandum of Understanding (MoU) with six professional bodies that will jointly design the training structure, certification pathways, digital skills initiatives, and mentorship platforms.

The professional bodies include:

- Institute of Chartered Accountants of Nigeria (ICAN)

- Chartered Institute of Bankers of Nigeria (CIBN)

- Chartered Institute of Stockbrokers (CIS)

- National Institute of Credit Administration (NICA)

- Chartered Risk Management Institute (CRMI)

- Nigerian Institute of Innovation and Entrepreneurship (NIIE)

Federal Government Statement:

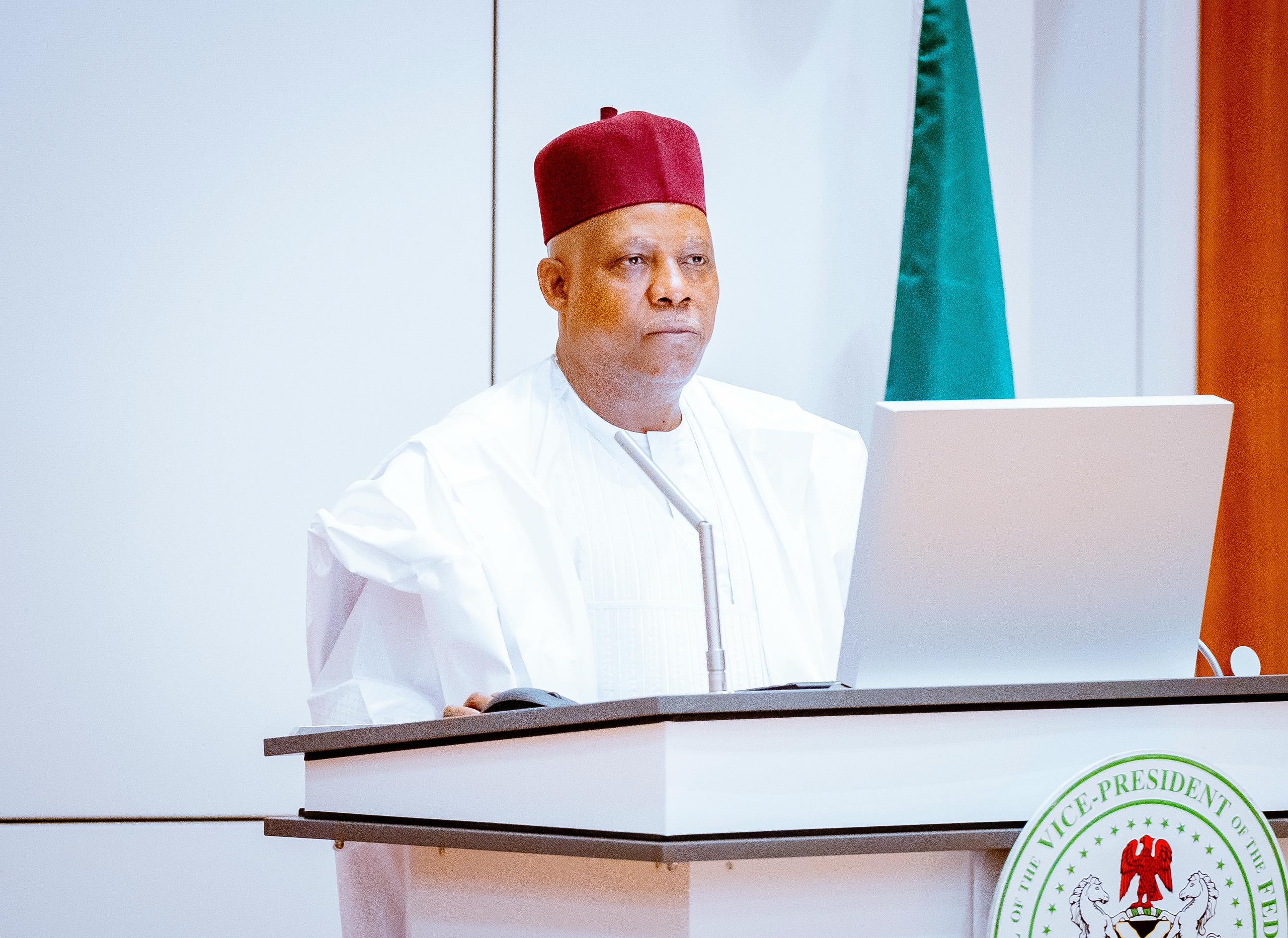

According to the statement, the initiative is being implemented by the Office of the Vice President through the Presidential Committee on Economic & Financial Inclusion (PreCEFI), chaired by Vice President Kashim Shettima.

Vice President Kashim Shettima said the signing of the Memorandum of Understanding (MoU) between the Federal Government and six professional bodies is “a strategic national investment in capacity as infrastructure which is the human, institutional, and ethical foundations upon which inclusive growth must rest.”

“Financial inclusion is not achieved by access alone, but by competence, trust, and capability. This MoU therefore establishes a working framework to harness the collective expertise of ICAN, CIBN, CIS, CRMI, NICA, and NIIE to advance inclusion through capacity building, advocacy, digital transformation, youth empowerment, and support for small and medium practitioners,” he added.

Senator Shettima emphasized that the programme prioritizes women and youth, highlighting that Nigeria’s demographic dividend will only be realised if young people are equipped with relevant skills and ethical grounding for a rapidly evolving digital economy.

Technical Partners Assure Readiness

Mr Emmanuel Lennox, CEO of WAWU Africa, the programme’s technical partner, assured readiness to provide the digital platform and enabling environment for successful training delivery.

Dr Nurudeen Abubakar Zauro, Technical Adviser to the President on Economic and Financial Inclusion, explained the need for the initiative, noting that financial inclusion is achieved not only through access but also by equipping people and institutions with the skills to use infrastructure responsibly and sustainably.

The event’s high point was the signing of the MoU between the Federal Government and the six professional bodies, marking the official start of the nationwide training.